STR Americas - Market Snapshot 2022/2023

The Americas had a successful year, building on hotel performance recovery already set in place from 2021. While the early months of 2022 showed lower performance due to Omicron, the region held strong from March onwards resulting in levels of average daily rate (ADR) and revenue per available room (RevPAR) that were higher than the 2019 comparables. Occupancy, while improved from the two years prior, still remained slightly below the pre-pandemic comparable.

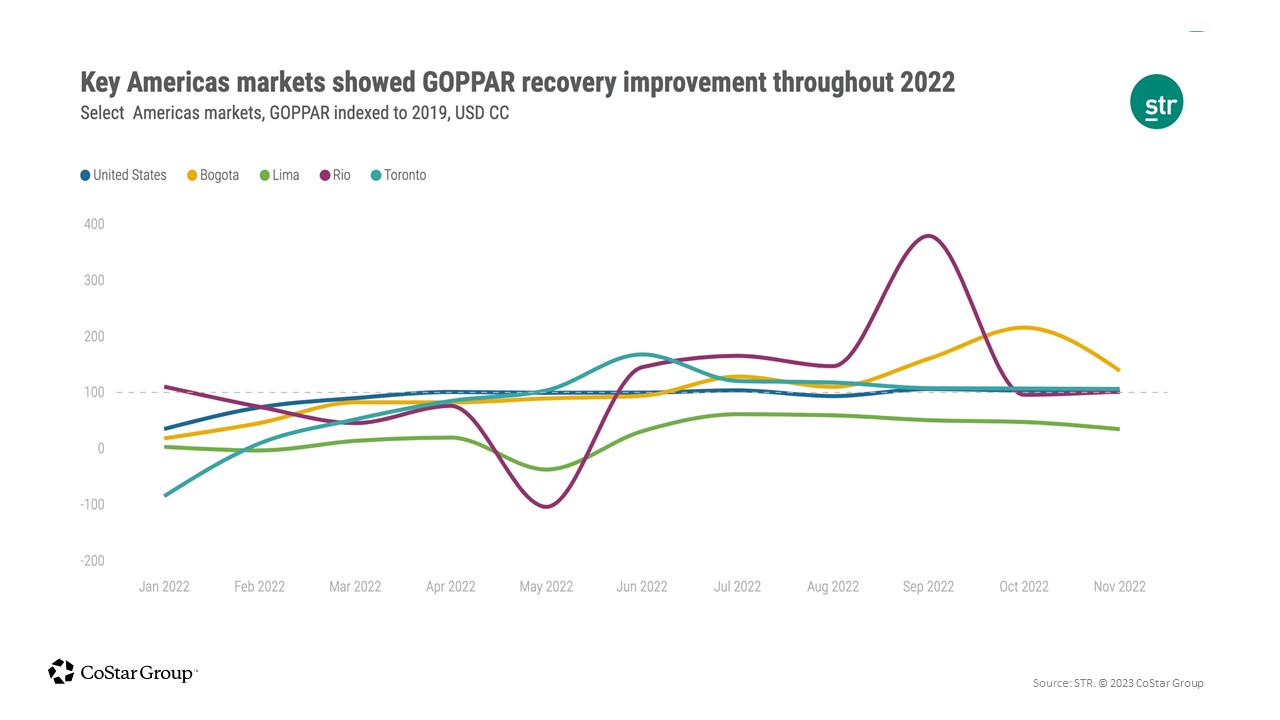

Despite the recovery in top-line performance, the Americas’ bottom line did not show the same level of momentum. The region’s hotel industry failed to reach or exceed 2019 levels in any of the profit & loss key performance indicators. The metric that came closest to its pre-pandemic comparable was labor costs, at 85% of 2019 levels, which followed a similar trend around the globe as the industry experienced high levels of hospitality unemployment throughout the year.

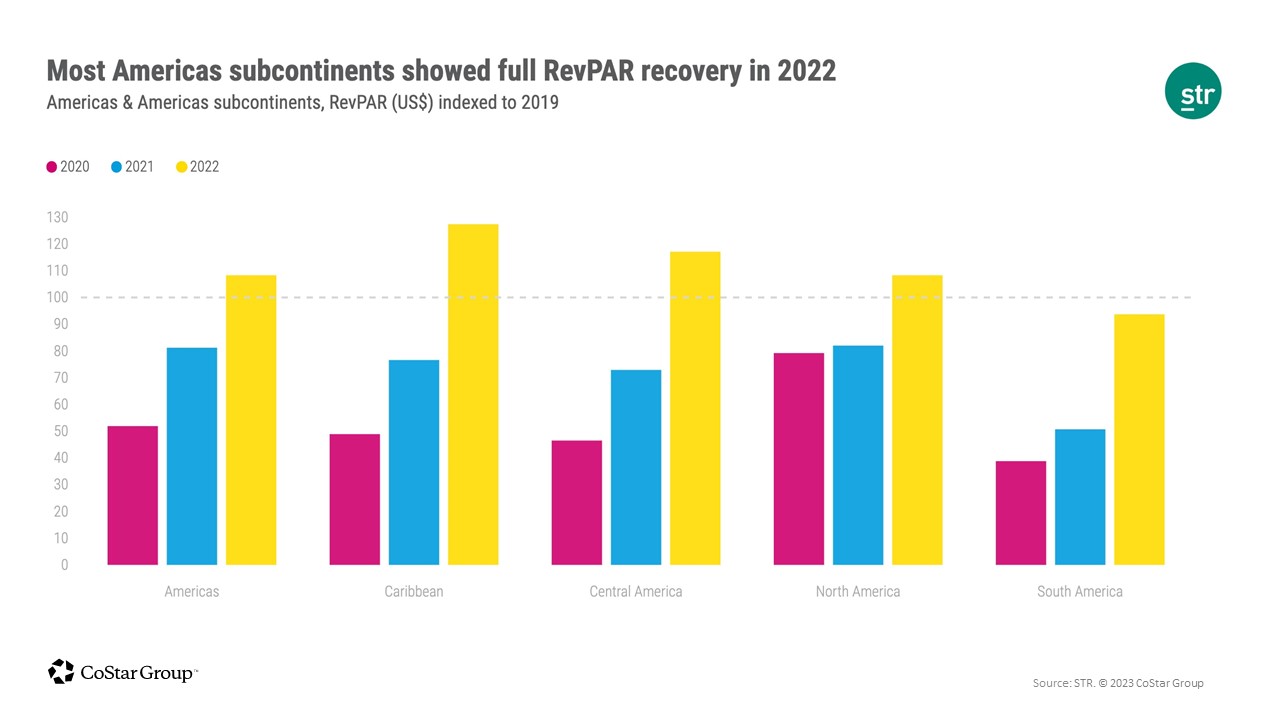

While the Americas showed a resurgence in top-line performance, recovery was not equal among the STR-defined subcontinents. South America was the only subcontinent to show a decline from 2019 in each of the three key performance metrics: occupancy (-2.6%), ADR (-3.8%), and RevPAR (-6.3%).

The subcontinent had a pretty good head start to recovery heading into 2022, due to seasonality (Q4/Q1 are summer months for most of the region) paired with an early reopening and decent domestic/intra-regional travel. While leisure demand-led recovery efforts, pent-up demand eventually slowed towards the end of the year. The other key consideration for South America was inflation, which rose much higher than in the U.S. or Europe, which in turn translated to higher ADR. Those higher inflation rates, however, have peaked and should start to steady this year.

On the other end of the spectrum, the Caribbean saw the greatest growth in both ADR (+31.6%) and RevPAR (+27.4%).

Puerto Rico has been a key piece of the recovery puzzle for the Caribbean, as the country has benefitted from the U.S. corridor, the fact that U.S. travelers do not need a passport or different currency to travel to Puerto Rico, and of course domestic tourism within the country. Two resort destinations, the Bahamas and Turks and Caicos Islands, have also benefited from the leisure traveler, with all three of these countries reporting the only increases over 2019 in each of the three key performance metrics. Opposite of the aforementioned countries, Trinidad and Tobago was the only country in the Caribbean to report a decline in all three metrics, reporting a steep decline in occupancy which resulted in a double-digit drop in RevPAR.

Moving north, the United States has had its own share of success as the country reported its highest ADR and RevPAR levels for any year on record in 2022. While the U.S. has mostly benefited from the continued strength in the leisure segment, there has been a substantial return of group business and increasing transient business travel, both of which are expected to grow further in 2023.

Across the U.S., inflation has been significant, peaking in June at 9.1% year over year. Since 2019, consumer prices have risen 14.5%. While inflation has helped propel rates, leisure-oriented demand also provided a boost. Overall, 40% of reporting U.S. hotels had ADR growth above of inflation (>15%) as compared to 2019. Seventy-five percent of reporting hotels in the luxury class saw ADR rise faster than inflation. When looking at real (inflation-adjusted) ADR, levels are still below 2019, but just by 0.8%. On a hotel-level, 40% saw real ADR growth above 2019.

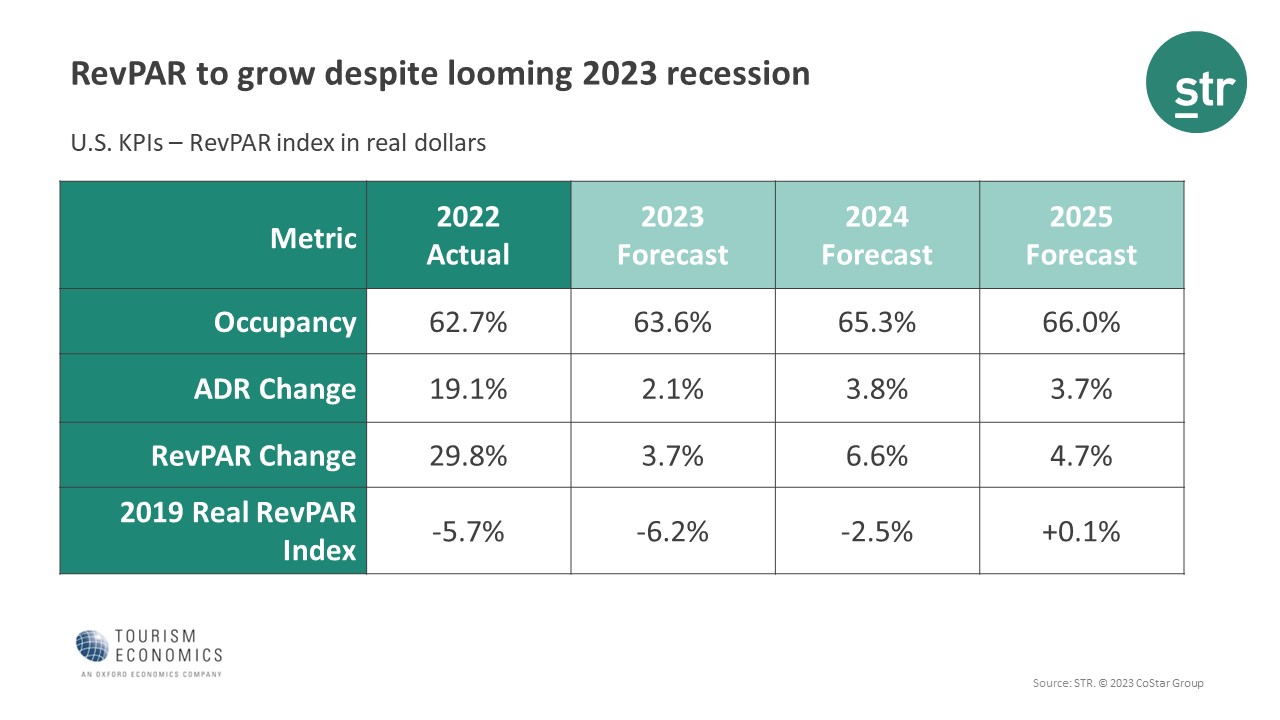

RevPAR at year end was up 28.9% year over year, which was 8% higher than the 2019 level. Real RevPAR ended the year 5.7% below 2019. ADR drove most of the growth in RevPAR as occupancy was at a 3.2% deficit to 2019.

Our 2023 U.S. forecast is centered around a widely expected mild recession taking place during the second half of the year. Forecasted GDP for 2023 will be a nearly flat 0.1%., and when broken down into quarterly sections, GDP is expected to be positive year over year in Q1 and Q2 and negative thereafter, however, government reporting will likely show declines on an annualized quarter-over-quarter basis in Q2 and Q3. We also expect to see reduced inflation in 2023 with the annual estimate for inflation hovering around the 3% - 3.5% range, which should contribute to ADR growth, on a nominal basis, slowing across the industry.

In our latest forecast with Tourism Economics, just released at the end of January, we projected occupancy to reach 63.6% in 2023, with ADR and RevPAR anticipated to increase over 2022, +2.1% and +3.7%, respectively. While RevPAR recovered on a nominal basis in 2022, we do not expect the metric to achieve that status when adjusted for inflation until 2025.

The U.S.’s neighbor to the north also experienced substantial performance recovery in 2022. Canada started off the year with a relatively lackluster performance compared to 2019, but the country was able to attain higher levels during the summer due to domestic leisure demand. Once restrictions at the border eased in the latter half of the year, the country’s occupancy levels were able to bounce back, however it was not enough to push the full yearly level over the 2019 comparable.

Canada’s economy has faced similar obstacles caused by higher inflation rates, which peaked in June at 8.1% and has since been trending downward. Although the country is expected to enter a moderate recession in 2023, we expect more recovery to take place throughout the year. Room rate growth, however, is forecasted to pull back while remaining in positive territory.

Moving forward, all eyes will be on international travel for countries throughout the Americas as this is a segment that, despite a resurgence, lacked in 2022. The same caveat can be applied to group/business demand as these segments were yet to show full recovery throughout the year but did give us a taste of what performance could be like if they were to fall back into the pre-pandemic pace. Despite economic headwinds, much of the industry is in a solid position moving into the new year.

Note: All financial figures presented in U.S. dollars.