Outlet or Boutique? The Strategic Power of Dual Revenue Management

Synopsis

For years, hotel revenue strategy has defaulted to a one size fits all model: optimize for RevPAR, chase occupancy, and call it success. But the landscape has shifted. Guests are savvier, channels more fragmented, and margin tighter than ever. In this complexity, a new clarity is emerging. Some hotels don’t want to be everything to everyone. They want to be something distinct to someone. That is where Dual Revenue Management steps in, not as a tweak to existing models, but as a rethinking of how value and volume can coexist. This is not about choosing sides. It is about choosing structure. A smarter, more nuanced framework where distribution is no longer a battlefield but a strategy board, and every move has a purpose.

The hotel industry has spoken a single dialect for decades: RevPAR, occupancy rates, and linear demand optimization. Like a retail outlet, where everything must go, but often at the cost of value and brand erosion. Yet, not every hotel aspires (nor should they) to be a high-volume operation. Some prefer to operate like a boutique in a creative district: carefully curated, margin-focused, and strategically selective. Here lies the tension between quantity and quality.

And it's precisely in this tension that the concept I call Dual Revenue Management finds its purpose. DRM doesn't ask hotels to choose between volume and value; it creates a dual-track system where both coexist, each governed by its logic, metrics, and priorities. And, in an industry polarized by digital ecosystems and fragmented distribution, this is not just a tactic; it's a structural rethinking.

Defining the Core Concept

Dual Revenue Management (DRM) is a strategic framework that separates and optimizes two distinct revenue streams within a single hotel operation: intermediated distribution (such as OTAs, wholesalers, bedbanks, and tour operators) and direct distribution (brand.com, CRM-driven bookings, assisted reservations, walk-ins, chatbots, etc.). Each of these ecosystems operates under a unique constellation of economic incentives, user behaviors, and technological constraints. Managing both streams under a single pricing strategy is like applying the same retail model to a shopping mall and a by-appointment-only Patek Philippe showroom. It flattens complexity, erases nuance, and ultimately leaves value on the table.

DRM breaks this model. It proposes differentiated KPIs, distinct pricing architectures, and (crucially) divergent objectives: maximize volume where scale wins, and maximize margin where control prevails. But DRM is not just a strategic framework; it’s an operational system. Born from over a decade of specialization in direct bookings, DRM translates high-level strategy into daily execution through a dedicated algorithmic layer and distribution-specific KPIs.

Unlike traditional revenue management strategies, which generalize across all channels based on occupancy trends or competitive sets, DRM isolates the direct ecosystem to calculate the most profitable rate for that channel alone. It leverages metrics such as Web Share, Direct Conversion Rate, and Web Demand to generate dynamic pricing suggestions designed to boost margin and accelerate direct acquisition.

Crucially, this is achieved without compromising the integrity of the global rate architecture. The hotel gains the flexibility to tactically oscillate between direct and indirect logics while preserving strategic coherence.

Supporting Data & Evidence

The promise of Dual Revenue Management is not theoretical; it’s empirical. And the numbers speak clearly. Let’s start with a paradox: despite the industry's best efforts to enhance the digital experience, direct websites still convert at only 1.5% to 3%. OTAs, by contrast, routinely achieve 10%+ conversion rates. The gap is real and persistent. So why invest in the smaller pond? Because margin matters more than volume. The acquisition cost of a direct booking is typically 50% lower than that of an intermediated one.

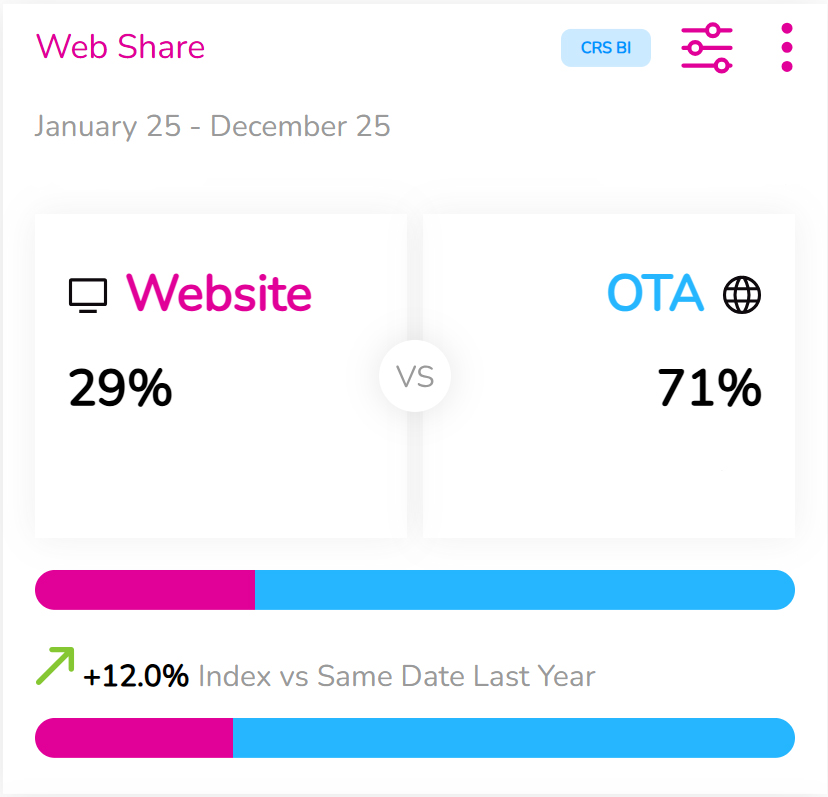

More importantly, studies consistently show that direct customers tend to exhibit a lifetime value up to 3x higher than those acquired via OTAs. That’s where DRM enters the picture: in properties adopting a dual revenue approach, we’ve observed a consistent pattern: net profitability improves, even when occupancy remains flat. The secret lies in margin optimization and a reduced dependence on discount-driven intermediaries. One KPI that has proven especially insightful in operationalizing this shift is Web Share: the percentage of total bookings that originate from the hotel’s brand.com. It captures the strategic health of the direct channel in a single, trackable metric.

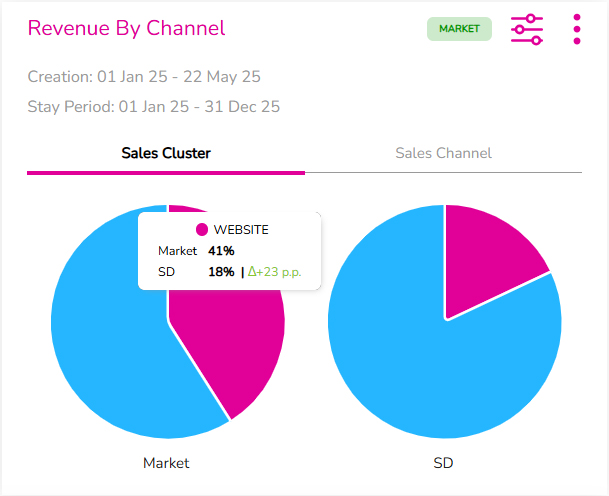

A standout example comes from our pilot property: a 4-star leisure hotel in a major Italian city, and the first to fully implement Dual Revenue Management, both strategically and algorithmically. Web Share increased by 12 percentage points year-over-year, despite no growth in traffic volume or promotional activity. The gain was driven purely by a pricing model tailored to the direct channel, powered by our algorithms. The implication is clear: when pricing logic reflects the unique dynamics of the direct ecosystem, performance improves, organically and sustainably.

This is not an isolated case. Since the start of 2025, we’ve expanded DRM, complete with its algorithmic engine, to a wider and more diverse group of hotels. These include both urban and leisure properties, ranging from 4 to 5 star, across multiple destinations. In this extended sample, the trend holds: comparing YTD data for stays in 2025 against the same booking window in the previous year, direct revenue share grew from 18% to 41%, without cannibalizing other distribution channels.

These are not just success stories; they are signals. They suggest that in a hospitality landscape increasingly fragmented by intermediaries and squeezed by rising acquisition costs, mastering duality may be the only path to clarity.

Strategic Application: From Theory to Playbook

Implementing Dual Revenue Management requires more than just tweaking a pricing algorithm; it demands a shift in organizational mindset and a recalibration of how success is measured across channels. Over my career, I came up with a 4-step approach:

1. Channel-Specific Pricing Models:

Intermediated channels operate in a hypercompetitive environment. Here, price elasticity and market visibility dominate. Dynamic pricing engines can optimize occupancy and compression windows, but should also factor in distribution costs and commission thresholds. Direct channels, by contrast, offer control. They allow curated offers, closed-user group promotions, loyalty incentives, and upselling opportunities. Pricing here should reflect yield, narrative coherence, and the ability to communicate value and build trust.

2. Differentiated KPI Tracking:

Rather than evaluating performance through a single lens (e.g., overall ADR or RevPAR), hotels should adopt dual dashboards: one tracking volume-driven metrics (occupancy, channel mix, cost per booking) and another focused on margin-driven KPIs (NetREVPar, CLV, conversion rate, direct-to-non-direct booking ratio).

3. Tech Stack and Data Alignment:

A Dual Revenue approach thrives when CRM, booking engine, RMS, and digital marketing tools are fully integrated. Data silos kill many things, and margin is one of them. Real-time insights into guest behavior, source attribution, and booking friction points are essential for optimizing the direct path.

4. Organizational Realignment:

Implementing Dual Revenue Management is not just about tactical precision; it demands a structural realignment across departments. The old silos between revenue, marketing, and digital are not just outdated. They're liabilities. Revenue managers can no longer be spreadsheet clerks forecasting demand in isolation. They must evolve into channel strategists: operators fluent in yield logic and narrative construction, capable of navigating an increasingly fragmented and algorithmic ecosystem. This isn't a theoretical shift; it's historical. As far back as the 2009 HSMAI Revenue Management & Internet Marketing Strategy Conference, voices like Eric Pearson and Bill Carroll were already declaring the end of classical revenue management as we knew it, forecasting its convergence with marketing. They were right. The traditional role is dead. What's emerged is a hybrid professional: part data scientist, part digital diplomat. Someone who doesn't just optimize for RevPAR but designs revenue architectures where each distribution channel becomes an intentional move, not a reactive default. Conversely, marketing can no longer rely on passive brand storytelling. In the DRM paradigm, it must become a performance engine that treats direct acquisition as both measurable and meaningful. Engagement must convert, not just resonate. The shared objective? A unified model where every direct booking isn't just a short-term win but the beginning of a long-tail relationship, a data point that feeds the next decision, and a signal of trust that can be monetized well beyond the initial transaction. This is more than realignment. It's a redefinition of roles built for a post-parity, post-silo (both tech and human) world.

Conclusion: A Grammar for the Post-Parity Era

The age of price parity is fading. Algorithms are increasingly more innovative than agreements, and consumers are more sophisticated than ever. In this new era, hotels need more than reactive tactics; they need a grammar that allows them to write different stories on different pages of the same book. Dual Revenue Management is that grammar. It doesn't oppose OTA being directed, but it orchestrates them. It recognizes that hotels must sometimes operate like outlets, sometimes like boutiques, but always with clarity on who they serve, how, and at what cost. So, the question is no longer whether to disintermediate but how to do it intelligently, profitably, and sustainably. This may be the next chapter: How can predictive data power a new kind of personalization that turns direct booking into direct connection? Because DRM is not about replacing volume with value. It's about harmonizing both. In doing so, I am writing a new chapter where direct isn't just cheaper. It's deeper.

1. Revenue Management and Internet Marketing Disciplines Converge at HSMAI Conference, Hospitality Net, https://www.hospitalitynet.org/news/4041094.html (last consulted on 22 May 2025).